Saudi Arabia plans to tap Islamic bond market to raise funding for Neom

Saudi Arabia is looking to raise over a billion dollars for the Neom megacity project from the sale of Islamic bonds, following reports that ambitions for the desert project have been scaled back.

Neom is looking into a plan to raise as much as $1.3 billion from Islamic bonds, or sukuk, as it looks to shore up funding for the $1.5 trillion megacity project, according to a Bloomberg report.

Saudi Arabia had expected 1.5 million people to be living in the 170km straight-line city by 2030. But Bloomberg reported earlier that officials now expect only 300,000 residents to be living there by that time.

Neom is the flagship project in Crown Prince Mohammed bin Salman’s wider plan to make Saudi Arabia’s economy less dependent on oil revenue and boost tourism, industry and the service sector.

Bloomberg reported in July that Neom hoped to raise $2.7bn in loans from local lenders. So far, most of Neom's funding has come from the kingdom's sovereign wealth fund.

Stay informed with MEE's newsletters

Sign up to get the latest alerts, insights and analysis, starting with Turkey Unpacked

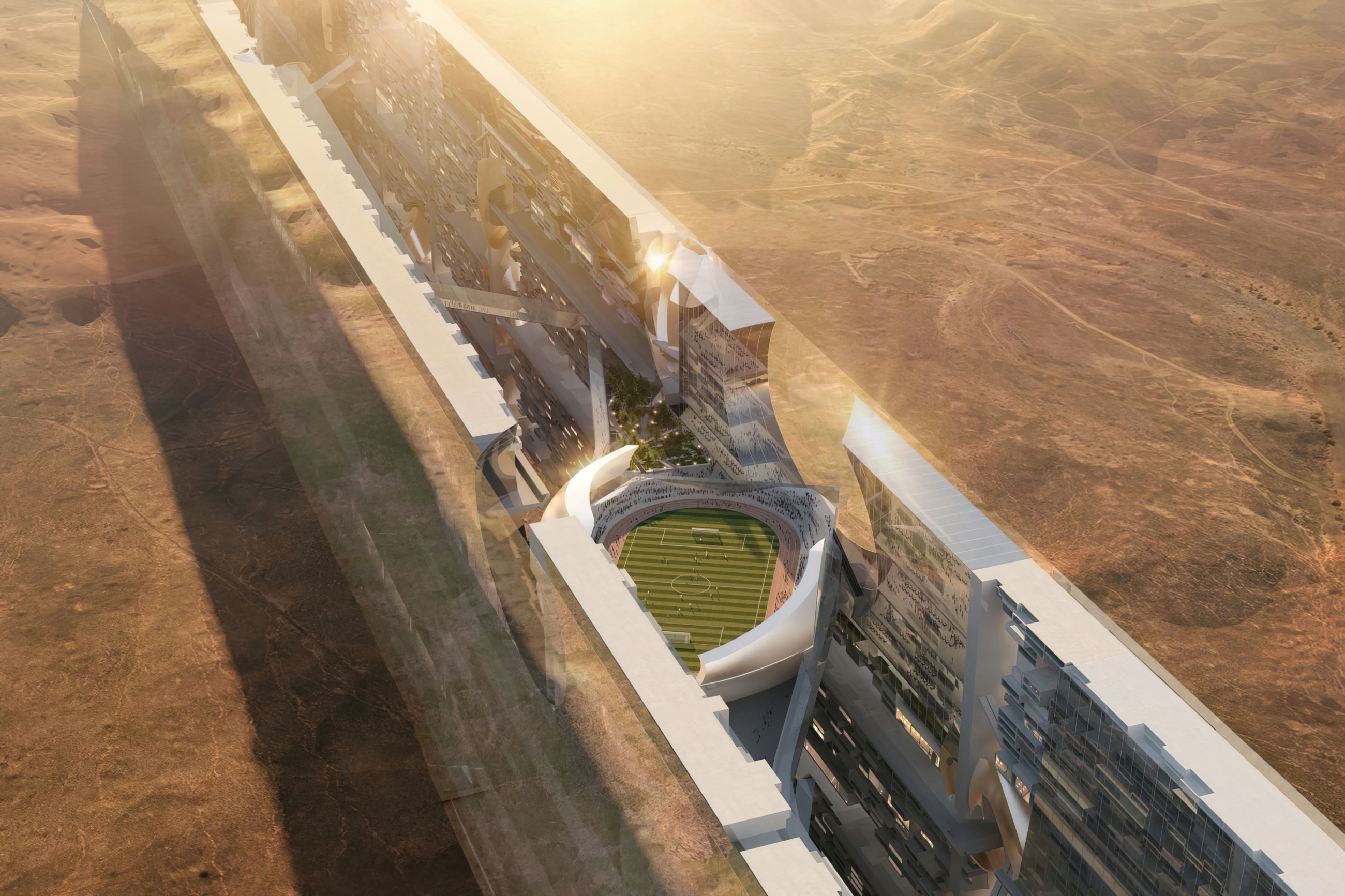

The Line, the horizontal city, is due to have no cars or roads and a high-speed rail service running across the length of the city. Two parallel, mirrored buildings that are nearly 500 metres tall and 120km wide are also planned as part of the project, according to designs uncovered in 2022.

Neom is also touted to include an eight-sided city that floats on water, a ski resort with a folded vertical village, and a Red Sea luxury island resort called, Sindalah.

Those efforts have had an impact. In March, Saudi Arabia reported that its non-oil economy reached a historic milestone in 2023, contributing 50 percent to the country’s real GDP.

Red Sea tourism and Gaza war

But the kingdom’s plans to draw millions of foreign residents and investors face obstacles, including a conservative culture where alcohol is still generally banned. In January, media reports said the kingdom was set to open the country's first liquor store, catering exclusively to diplomats.

Western tourists who have visited Saudi Arabia’s Red Sea coastline have come away with mixed reactions, remarking on its beauty but noting high prices and an overbearing bureaucracy, Middle East Eye has previously reported.

Saudi Arabia also faces stiff competition in the luxury development space from Qatar, Oman and the United Arab Emirates.

The war in Gaza has also revived geopolitical concerns among investors and travellers.

Houthi fighters in Yemen have launched a campaign against commercial shipping, in what they say is in retaliation for Israel’s war on Gaza.

While they have said they are not targeting their Arab neighbours, their drone and missile attacks have led to cruise ship cancellations in the Red Sea, underscoring how their attacks can ripple into Saudi Arabia’s tourism and development ambitions.

Sindalah, the Red Sea resort that is part of the Neom project, is due to open later this year.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.